Economic Vibrancy Comparison/Report: Job Growth Comparison Deep Dive

By REDI Cincinnati Research Department, with contributions from Rodney Wilson, Bryan McEldowney, Aida Ramusovic-Witham and Rosa Christophel

REDI Cincinnati recently embarked on a blog series examining an economic comparison report led by REDI’s research team. The comparison benchmarked Cincinnati in six strategic areas—growth, talent, innovation, housing, prosperity and inclusivity—against 39 peer MSAs ranging from 1-4.5 million people. This post serves as a follow-up to the most recent area examined—growth—and provides greater context around job growth in the region.

Read the introduction to the blog series here.

Please note that each of the four aspects examined in this blog considers data from different time periods. The data used in this report is made publicly available at both different points in time and at varying intervals. For transparency, the time frames are noted in parentheses in each sections’ headline.

—

Job Growth Compared to Other MSAs (Data point in report from Sept 2020- Sept. 2021)

The year spanning September 2020 to September 2021 saw a net increase in employment across all the regions we studied save one, New Orleans, a benchmark city that sat on the bottom end of our range with a -1.3 percent decrease in employment.

In the range of the 40 MSAs we looked at, Cincinnati was positioned in the lower 50 percent with an employment increase of just 2.9 percent. Any suggestion of underperformance, however, is misleading as our region’s pandemic job rate was remarkably better than most of the other benchmark regions. The nearly 30,000 jobs added in the studied timeframe, then, were added to an already strong regional employment positioning.

The takeaway? Cincinnati’s stellar employment resiliency during the worst of Covid-19’s effects made for a remarkably strong post-pandemic positioning. The region’s continued employment growth can be viewed as improvements to an already strong employment sector.

Educational Attainment within Our Region’s Talent Pool (Data point in report from Sept 2020- Sept. 2021)

There’s no denying that educational attainment is a key indicator of employee talent availability for a region, and in this area, Cincinnati is markedly strong, though with room for improvement—which our reports indicate is, indeed, happening.

For example, nearly 38 percent of regional residents between the ages of 25 and 64 hold a bachelor’s or advanced degree. (Associate degree attainment is about 7 percent for the same age group.)

In our studied group of MSAs, San Jose sat at the top of the range with just more than 55 percent of the population holding bachelor’s degrees; Las Vegas, at around 25 percent, was at the bottom. Cincinnati, then, was positioned in the middle among benchmark communities— though, notably, educational attainment levels in the region continue to increase. Today, the region is far more apt to attract college-educated migrants than just six years ago.

And the stellar colleges and universities in the region produce significant levels of science, technology, engineering, and math (STEM) graduates. For every 10,000 regional residents in 2019, Cincinnati produced around 19 STEM graduates for a total of 4,000 STEM degrees awarded in that year alone. And in the past five years, the number of awarded STEM degrees rose by more than 70 percent on a per capita basis.

These educational gains translate to employment improvements, as computer and math workers comprise more than 3 percent of the Cincinnati region’s workforce, while technology jobs make up just under 2 percent of regional employment—a modest improvement over the past few years.

Talent Attraction & Retention (Data point in report from Sept 2020- Sept. 2021)

Retaining native-born talent has, historically, been a challenge for our area where, as recently as 2017, it was noted that more people with a college degree left Cincinnati than moved into the region.

There is good news on this front, though, as our region has reversed the outflow of talent that traditionally characterized this region. In fact, in 2019, we observe a net gain of 29 college-educated migrants for every 10,000 existing residents. This dramatic turnaround puts Cincinnati in the top 50 percent among the MSAs we looked at.

Still, we could do better, most notably in the area of young talent migration. Cincinnati has one of the smallest proportions of young professionals among all examined regions at just 26 percent of our population. Additionally, this proportion of young professionals in the region hasn’t increased in recent years—in fact, between 2014 and 2019, the young professionals demographic actually decreased in our region, a dynamic observed in only eight of the 40 examined regions.

However, Cincinnati has demonstrated its midwestern grit in working to reverse that trend. In the four years between 2019-2022, the metropolitan ranked as SmartAsset’s No. 1 city for new college graduates. And, as recently as 2021, Self Financial listed Cincinnati among its top-15 best-paying metros for recent college graduates and with a cost of living 9.4% below the national average.

Growth Industries for Our Region (Lightcast 2023.1)

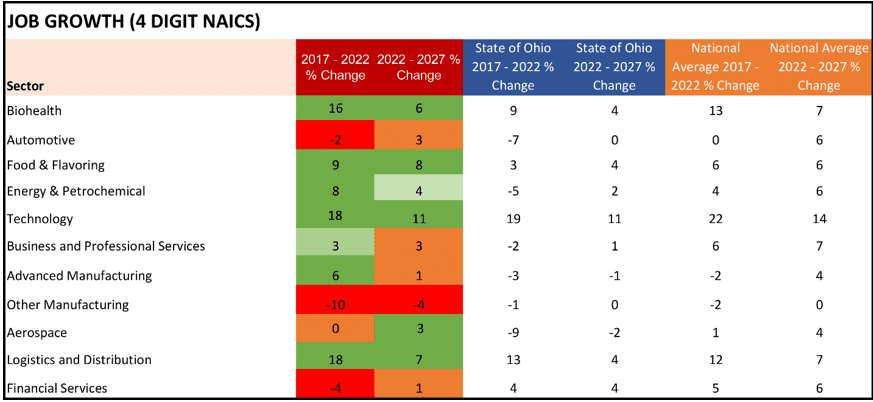

As we analyze Cincinnati’s employment data alongside benchmark MSAs, it’s important to note specific industries in which our region shows employment strength.

REDI has highlighted major target industries—Life Sciences, Technology, Business & Professional Services, and Advanced Manufacturing—and Cincinnati shows projected job growth (Chart 1) in all four of these sectors. In fact, in almost every other industry classification beyond these big four, Cincinnati is also expected to add jobs, with Food & Flavoring, specifically, indicated to become a significant employment market in the coming years.

Chart 1: Industry Subsector Job Growth comparison between 2017-22 and projected 2022-2027. (Lightcast)

Today, Cincinnati shines as an economic powerhouse, with employment data above and beyond the national average in logistics, advanced manufacturing, and technology. And with factors such as cost of living, culture and entertainment, athletics teams, and more bolstering the city’s national reputation, we have what it takes to attract highly skilled workers to our area for the industry employment opportunities of tomorrow.