Foreign Trade Zones and Supply Chains: How FTZs can help in an era of offshoring, onshoring, and omni-shoring

The globalized economy has been a remarkable achievement because raw materials, manufactured goods, and finished products are moved around the planet and delivered to end users via just-in-time supply chains to end-users. While this process involves long supply chains, they have been able to remain basically stable so long as global economic conditions were stable. Recent events, however, have affected that stability. Trade policy has changed, including new tariffs under the previous administration, new Buy America regulations, and an Executive Order to strengthen the resilience of America’s supply chains. New technologies are having an impact too. Smaller items like tracking sensors are changing the way the “cold chain” works for items that must be temperature regulated. Other technologies, like lithium-ion batteries to power cars, effectively involve the creation of entirely new supply chains. Finally, the Covid-19 pandemic has had effects on the flow of goods and labor throughout global supply chains. These effects are still ongoing, but an important effect of the pandemic has been to magnify weaknesses in existing supply chains.

Some of the responses to this instability have included onshoring, whereby production is brought back to the United States. Another response is “omni-shoring” where importers maintain existing supply relationships but add a second supplier in a different country. This adds complexity to a supply chain but also provides resilience and stability in the face of uncertainty.

Foreign Trade Zones 46 (Southwest Ohio) and 47 (Northern Kentucky) may be able to assist Greater Cincinnati businesses with these responses. The rule of thumb is that if a business is annually importing more than $3m in goods, then becoming a Foreign Trade Zone (FTZ) operator may be a good fit. The FTZ Program was established by the Federal Government in the 1930s to provide a level playing field for American businesses competing with overseas businesses. FTZ regulations have been modified over the years to make FTZs more useful, and there are now several hundred zones throughout the United States. FTZs provide cost savings to businesses that operate in zones in three basic ways: duty deferral, eliminating inverse tariffs, and consolidated entries.

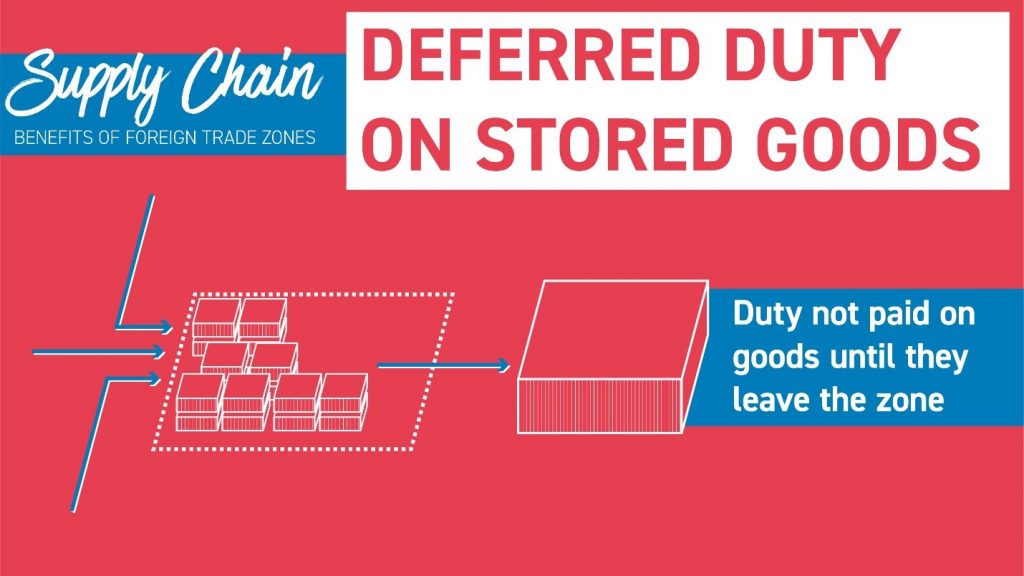

In an FTZ, duties and taxes on imported materials are not paid until goods exit the zone. The space in a zone is considered to be outside the American commerce system, and goods stored in a zone do not enter the commerce system until they leave the zone. This unique aspect of FTZs allows them to assist with evolving supply chains in unique ways.

If a warehouse space is included in a zone, duties will be deferred on goods until they leave the zone. This can make it more affordable to build up inventory and stockpile resources. A zone operator can order additional to products or raw materials and not pay the duties until those items are needed and they leave the zone. Depending on the overall cost to stockpile goods, there may be reduced financing costs to defer the duties. Additionally, companies can see cash flow benefits to delaying duty payment on products until they are closer to the time of sale.

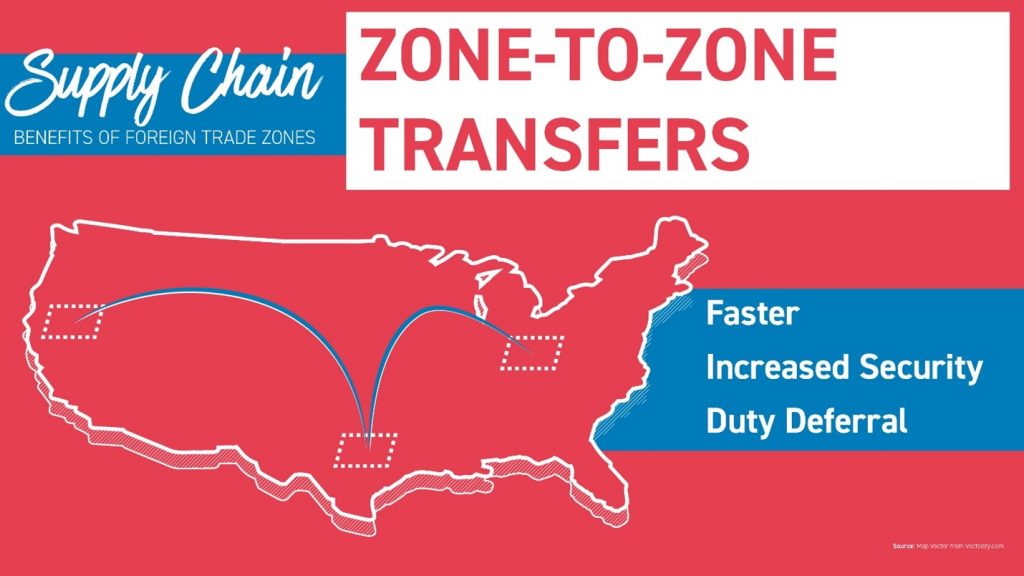

Zone-to-zone transfers can expedite movement of freight from coastal ports into regional zones. The Pan-Pacific supply chain that brings goods into the United States through a limited number of crowded West Coast ports has been impacted by the pandemic. Just-in-time delivery may not be just-in-time anymore. If goods are first brought into a Zone, then shipment to another Zone can be faster when compared to goods outside a zone. FTZs provide more security than the standard importing procedures, the FTZ admission process is automated, and advanced manifests are provided to Customs and Border Protection. Collectively, the additional security and digital tracking make it faster to transfer goods from a coastal FTZ to an inland zone.

For most goods brought into the country, Customs and Border Protection charges a Merchandise Processing Fee (MPF) for each entry. If the operator is in an FTZ, all the entries in one week can be consolidated into a single entry, paying that fee just once. For importers adding new suppliers or “omni-shoring” their supply chains for added resiliency, consolidated entries can provide cost savings as they receive additional shipments from new suppliers.

In limited cases where speed to market is critical, zones can be used when certain federal approval processes are still pending. This aspect of FTZs was used to great effect during the pandemic when pharmaceutical company Pfizer imported shipments of vaccines into FTZs. While awaiting FDA approval, vaccines were able to be stockpiled in FTZs, enabling a faster rollout immediately upon FDA emergency use authorization. This reduced the time from approval to vaccines being administered and provided certainty in scheduling and deliveries. The National Association of Foreign Trade Zones (NAFTZ) has a great writeup about this on their website.

As Greater Cincinnati businesses work their way through changing global supply chains, it is worth considering Foreign Trade Zones as a potential tool. Zone 46 (Southwest Ohio) and Zone 47 (Northern Kentucky) are locally administered by a Board of Directors made up of industry professionals. The Port of Greater Cincinnati Development Authority (The Port) handles the day-to-day management of the FTZ program in close coordination with Customs and Border Protection. For more information on the Greater Cincinnati Foreign Trade Zones or to reach out with questions or comments, please visit gcftz.com.